Green For Green: The Cost Of Environmental Protection

By IBISWorld Business Research Analyst, Daniel Krohn

As the EPA implements environmental regulations, the prices of goods and services from three key sectors will rise.

American concern for preserving natural resources and promoting sustainability has grown substantially during the past decade. This trend has spurred strong denizen support for government regulations that protect the environment from corporate exploitation, which has urged the Environmental Protection Agency (EPA) in particular to institute legislation that will hold businesses more accountable for their impacts on the environment – particularly those in the energy, construction and mining sectors. To do so, operational costs for the companies in these sectors are on the rise as they strive to comply with regulation and lessen their environmental impact, a trend that is anticipated to continue in the coming years. As a result, businesses that are heavily reliant on goods and services from the energy, construction and mining sectors are likely to see their own operational costs rise as their suppliers pass down cost increases.

Throughout 2015, five key pieces of legislation – the Clean Air Act (CAA), Clean Water Act (CWA), Mercury and Air Toxics Standards (MATS), Resource Conservation and Recovery Act (RCRA) and Toxic Substance Control Act (TSCA) – will be revised. Once finalized, these revisions will substantially elevate the prices of a wide assortment of goods and services that the energy, construction and mining sectors provide, including natural gas, paints and coatings and nonferrous metals. Businesses reliant on goods and services from these sectors should develop a strong understanding of these impending legislative changes and what markets they affect to make better purchasing decisions.

Energy Sector

The energy sector is expected to take the largest hit from regulatory change in 2015. The EPA has proposed to enforce stricter standards for the emissions of greenhouse gases, the discharge power plants release into US waterways and the handling of underground fuel tanks. These actions are projected to elevate electricity, natural gas and fuel prices in the upcoming years.

The energy sector is expected to take the largest hit from regulatory change in 2015. The EPA has proposed to enforce stricter standards for the emissions of greenhouse gases, the discharge power plants release into US waterways and the handling of underground fuel tanks. These actions are projected to elevate electricity, natural gas and fuel prices in the upcoming years.

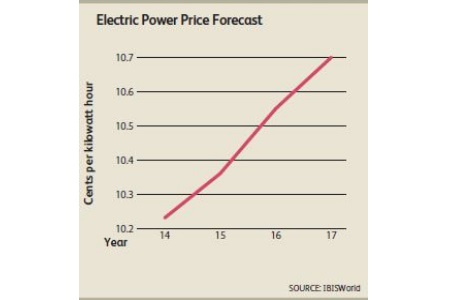

Coal-fired power facilities are expected to be a primary target of new legislation in 2015. An estimated 1,500 power plants in the United States are coal-fired facilities that generate nearly half of the country’s electricity. In the process, however, they produce large quantities of pollutants, such as ash and CO2, which are detrimental to the environment and public health. The EPA is expected to use the authority granted to them under the CAA, CWA, RCRA and MATS to tighten standards regarding emissions and discharge from coal-fired powered facilities. These standards will encourage power plants to switch from coal to natural gas, install additional carbon capture and storage technologies, add additional coal ash filtration systems and take additional precautions when disposing coal combustion residuals. IBISWorld expects the costs of complying with these new EPA standards will contribute to projected 1.5% annualized growth in electricity prices in the three years to 2017. Meanwhile, these standards are expected to stimulate demand for natural gas and, in turn, help pushnatural gas prices up at an annualized rate of 7.0% from 2014 to 2017.

Furthermore, under the revised regulations to the RCRA, fuel vendors will be required to undergo additional training on the proper operation of fuel storage tanks, update their underground storage leak prevention and detection system with the latest technologies and install systems that run cleaner fuel. These requirements will increase the operational costs of fuel vendors, growth that IBISWorld expects to contribute to a 2.9% annualized rise in gasoline prices and a 1.3% annualized boost in diesel fuel prices in the three years to 2017.

Construction Sector

The construction sector is highly reliant on painting and demolition contractors, brick and structural clay products, as well as paints and off-highway trucks. Upcoming revisions to the CAA are projected to inflate the prices of brick and structural clay products and medium- and heavy-duty vehicles. Meanwhile, changes to the TSCA will increase the cost of manufacturing paint and call for additional training for painting and demolition contractors. Consequently, these revisions are projected to stimulate price growth in markets throughout the construction sector.

In 2015, revisions to the CAA will strengthen the emission standards imposed on brick and structural clay product manufacturers. These revisions will require brick and structural clay product manufacturers to take additional measures, such as replacing their kiln and dust control equipment more frequently and using cleaner fuels, such as natural gas to reduce their emissions of harmful byproducts. In turn, these standards are expected to inflate the costs of brick and structural clay manufacturers, which IBISWorld projects will to contribute to an annualized rise of 3.4% in masonry and stonework services during the next three years. Under the CAA, the EPA is also expected to set stricter emissions standards for medium- and heavy-duty vehicles, which will force manufacturers of these vehicles to invest heavily in research and development. IBISWorld expects these investments will help ignite a rise in off-highway truck prices at an annualized rate of 9.0% through 2017.

Upcoming revisions to the TSCA are also projected to inflate costs within the construction sector. These revisions include lowering the limit for the tolerable amount of lead used in manufactured or imported paints, imposing stricter scrutiny regarding the disposal of polychlorinated biphenyls, asbestos, radon and lead-based paint and instituting more stringent training and certification requirements for workers that remodel, repair or paint child-occupied buildings. Consequently, operational costs within the paint and coatings manufacturing market are expected to rise. Furthermore, foreign competitors that do not meet the more stringent regulatory standards will be eliminated from the US market, thereby reducing competition. IBISWorld anticipates these trends will encourage growth in paint and coatings prices at an annualized rate of 3.2% during the three years to 2017. Meanwhile, stricter disposal, training and certification standards are expected to elevate the operational costs associated with demolition service and painting service contractors, contributing to a 4.4% annualized increase in painting service prices and a 4.5% rise in demolition service prices during the next three years.

Mining Sector

Regulatory change will also impact the mining sector in 2015. Many of the same revisions forecast to affect the price of medium- and heavy-duty vehicles used in the construction sector will also elevate the prices of vehicles used in mining. Meanwhile, under the CWA, the EPA is expected to extend its influence over the issuance of permits, thereby making it more difficult for mining companies to mine in US waters and wetlands. Outside of US waters, mining companies are held to stricter standards regarding permitting and reporting when they operate within proximity to a waterway. Upcoming revisions to the CWA are expected to broaden the area surrounding US streams in which mining companies are held to these more stringent standards.

Regulatory change will also impact the mining sector in 2015. Many of the same revisions forecast to affect the price of medium- and heavy-duty vehicles used in the construction sector will also elevate the prices of vehicles used in mining. Meanwhile, under the CWA, the EPA is expected to extend its influence over the issuance of permits, thereby making it more difficult for mining companies to mine in US waters and wetlands. Outside of US waters, mining companies are held to stricter standards regarding permitting and reporting when they operate within proximity to a waterway. Upcoming revisions to the CWA are expected to broaden the area surrounding US streams in which mining companies are held to these more stringent standards.

In light of these upcoming revisions, IBISWorld anticipates that operational costs will rise throughout the mining sector and mining activity will slow, thereby reducing the supply of mined resources. These trends are projected to apply upward pressure to the price of mined resources. In particular, the United States is a large producer of nonferrous metals such as aluminum, copper, zinc, titanium, lead and molybdenum. IBISWorld projects that the price of nonferrous metals will grow at an annualized rate of 6.3% in the three years to 2017, due in part to these upcoming regulatory revisions. This growth is expected to inflate the prices of a large number of metal products.

Implications of Impending Regulatory Change

Not only will upcoming revisions to key legislation elevate the costs of goods and services within the energy, construction and mining sectors, they will also indirectly inflate the prices of a wide assortment of other business-to-business goods and services in the coming years. Businesses heavily reliant on goods and services from the energy, construction and mining sectors are advised to take the time to evaluate their vendors’ supply chains and use long-term contracts to lock in current prices. Moreover, these businesses are advised to devote additional time to ensuring their vendors comply with new regulatory standards and consider enlisting legal counsel to assist in these assessments. Although these precautions will make procurement more expensive, they will protect the buyer from costly EPA-sanctioned penalties and public lawsuits down the road.

For a printable PDF of Green for Green: The Cost of Environmental Protection, click here at http://www.ibisworld.com/media/wp-content/uploads/2014/11/Green-For-Green.pdf.

Source: IBISWorld, Inc.